Why does every business need the help of an accountant?

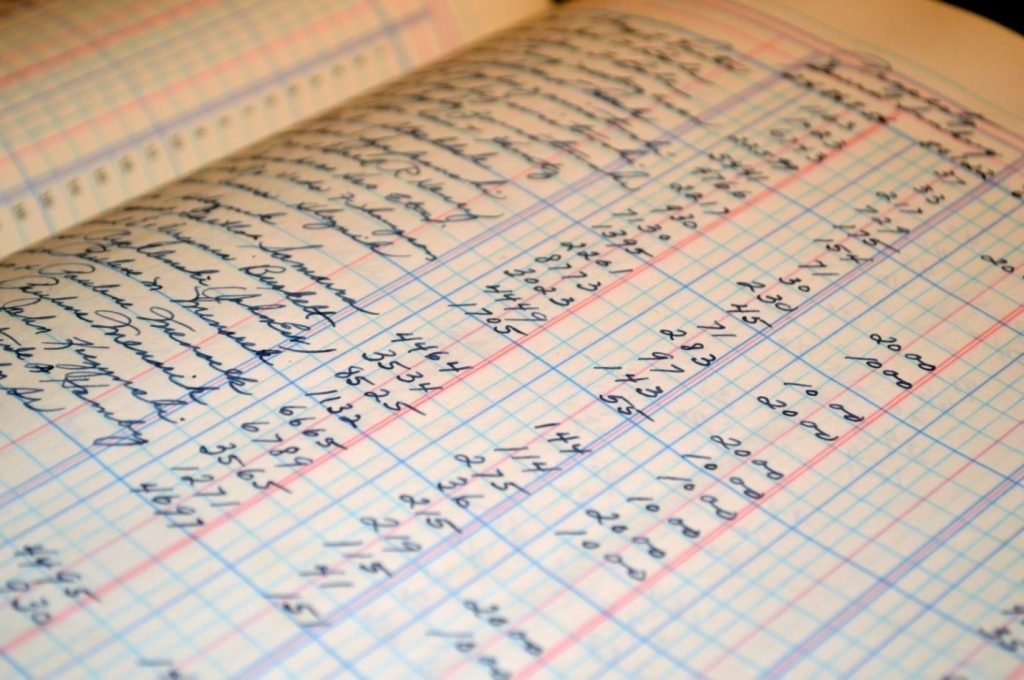

If you’ve been in business for a while, then you know that accountants can be an indispensable part of your team. Accountants can help run your finances, keep your books and even plan better for the future of your business. But what are some other benefits of hiring an accountant? Get help for your business […]

Why does every business need the help of an accountant? Read More »