You’re rushing toward the end of the financial year and realize that a lot has to be done before the year-end accounts can be reconciled. You need to track all the receipts and other transactions and compile them, but it’s either too complicated, or there just isn’t enough time to do so.

Without getting your books on track, you can’t possibly figure out where you stand financially, nor can you take any moves to tackle the taxes that lay ahead. The following steps will guide you on how to get your books on track for year-end:

Step 1: Organizing All the Required Documents

The first step is to divert all your focus toward finding all the necessary financial documents. Look for transactional documents in your drawers, email inbox, downloads folder, and all sorts of physical and virtual places that you can think of. Don’t get to arranging or compiling them now; just focus on gathering them.

Once you have all the sources with you, separate each document into expenses or income. Then, sort them in chronological order, arranging them month-wise.

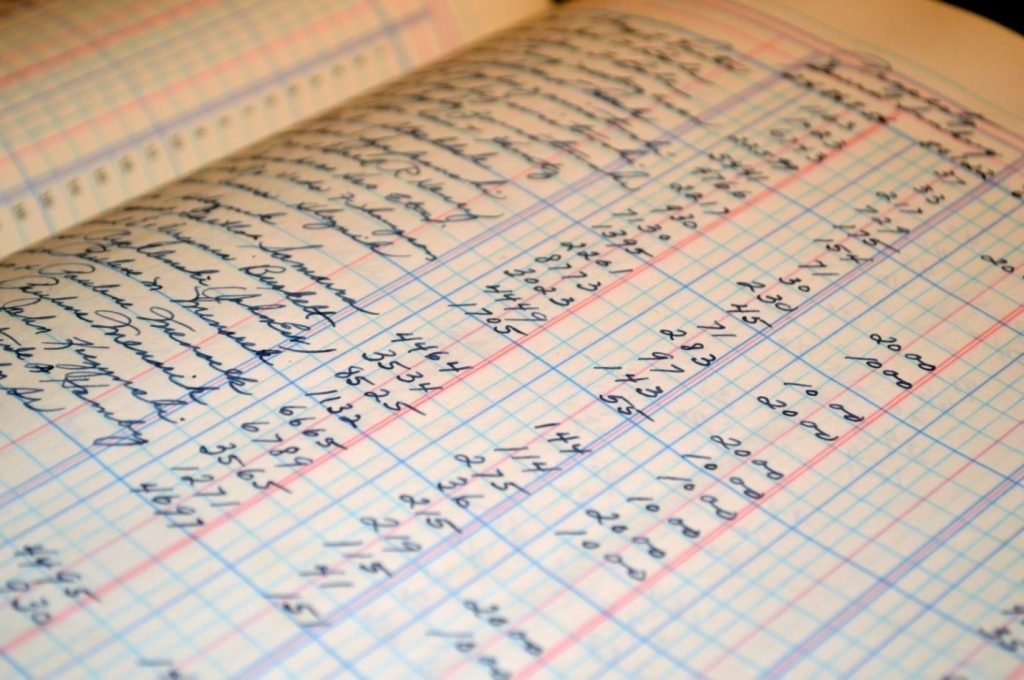

Step 2: Posting Transactions

Without proper bookkeeping, you can’t keep track of all your expenses and income, which means that you can’t prepare your income statements to determine your profit or loss. It is important to list and post all transactions in a general ledger to be able to prepare your financial statements at the end of the year. Once you’ve formulated the financial statements, you can easily make important business decisions.

Step 3: Analyze Your Income

The next step is to analyze your revenue and expenses for the year. Determine whether they have increased or decreased during the year and how they have impacted the overall profit. Besides giving a clear picture of the businesses’ financial health and profitability, the statements will help you track changes in your tax liability for the year. These findings will help you determine what adjustments need to be made to your tax payments.

Step 4: Identify Tax Deductions

Tax liability and deductions are subject to change every year. For instance, the corporate tax rate for 2019 is set at 21%. While you can still deduct necessary business-related food costs up to 50% but some deductions, such as entertaining clients, are no longer permitted. As per the new law, for business property acquired and used for business between 27th September 2017, and 1st January 2023, 100% expensing is allowed.

Make sure you are aware of these and other changes in the tax deductions applicable for this year.

Step 5: Seek Professional Services

In the face of rapidly increasing business competition, taxation laws are becoming increasingly harsh. As a result, the majority of businesses end up overpaying their taxes. To understand the new tax laws and make the most out of tax deductions, you should consult a qualified CPA who will guide you on the best ways to attain tax advantages, such as donating to specific charitable organizations or making certain purchases.